Showing top 0 results 0 results found

Showing top 0 results 0 results found

What you’ll learn from this article:

-

Why joining the Text Partner Program amplifies your CLV strategy.

-

Tools and technologies to track the average customer lifespan.

Key findings:

Why customer lifetime value matters in ecommerce

Customer lifetime value reveals a customer’s true long-term worth, helping brands focus on retention, profitability, and sustainable growth rather than just short-term sales.

How agencies can utilize customer lifetime value

By focusing on CLV, agencies shift from one-off campaigns to sustainable growth models that maximize profitability for their clients and identify high-value customer segments to tailor retention, personalization, and marketing strategies that drive repeat purchases and long-term revenue.

Let’s face it, ecommerce isn’t just about getting clicks and conversions anymore. Sure, paid ads, flashy product drops, and viral campaigns might get customers in the door. But if you’re an ecommerce agency still laser-focused on customer acquisition alone, you’re leaving serious money on the table. Why? Because the real difference — the metric that separates growth from burnout — is customer lifetime value.

It tells you how much a customer is actually worth to a brand over time, not just in that first checkout moment. And in an era where ad costs keep rising, third-party cookies are disappearing, and shoppers expect more than ever, it’s never been more important to think long-term.

This article breaks down what customer lifetime value means, why it should be at the center of your ecommerce strategy, and how agencies can help their clients unlock exponential growth by focusing on the entire customer journey, not just the first sale. Let’s dive in.

What is customer lifetime value (CLV)?

Customer lifetime value, often shortened to CLV, isn’t just another ecommerce buzzword. It’s a powerful metric that tells you how valuable a loyal customer is to a business over the entire span of their relationship, not just the first transaction.

At its core, CLV = average order value x average purchase frequency rate x average customer lifespan.

Let’s break that down:

-

Average order value: How much the customer spends per purchase.

-

Average purchase frequency rate: How often they buy within a given period.

-

Average customer lifespan: How long they keep coming back before churning.

So, if a customer’s average purchase value is $50 per order, they buy three times a year, and they stay for four years, their customer lifetime value calculation is $600. That’s the kind of insight that transforms your strategy.

CLV shifts your mindset from "How do we get this person to convert right now?" to "How do we turn this person into a loyal, repeat customer who drives long-term revenue?"

And here’s where it gets even more useful: when you compare CLV with customer acquisition cost (CAC). If it costs you $100 to acquire a customer and their CLV is only $120, you’re barely breaking even. But if you can boost that CLV to $300 or $500, suddenly your entire business model becomes more profitable and scalable.

Understanding CLV is like having a north star for strategic decisions: it tells you who your best existing customers are, where to invest your time and budget, and what efforts are truly increasing customer retention.

Why CLV matters in ecommerce

If your entire growth strategy hinges on acquiring new customers every month, you’re basically on a never-ending treadmill. Sure, it might work for a while. But over time, rising ad costs, changing consumer behavior, and privacy updates make it harder and more expensive to keep that machine running.

That’s where customer lifetime value becomes an advantage. It’s the metric that tells you whether your business is built for longevity or just temporary traction. Here’s why ecommerce brands, and the agencies behind them, need to take customer lifetime value seriously:

Retention costs less than acquisition (and pays more over time)

Acquiring new customers is expensive. Between ad spend, influencer campaigns, and promotions, the upfront cost can quickly eat into margins. On the other hand, retaining an existing customer is cheaper and often more profitable.

Example:

If it costs $80 to acquire a customer who only spends $90, your profit margins are barely breaking even. But if that same customer returns three more times without additional acquisition cost, suddenly that $80 becomes a high-ROI investment.

Strategies to retain customers, such as email marketing, loyalty programs, and proactive customer service, can be far more cost-effective and scalable than constantly feeding the customer acquisition machine.

It creates predictable, compounding revenue

Customer lifetime value helps you build a healthier customer revenue model. By understanding how long a loyal customer stays and how much they spend, you can forecast average revenue with more confidence and build long-term strategies.

Think of it this way:

Would you rather sell once and start over… or sell to someone who loves your brand and keeps coming back, month after month?

Agencies that track customer data and grow customer lifetime value help brands compound their average revenue over time, which makes them far less vulnerable to seasonal dips or platform algorithm changes.

It leads to smarter, more targeted marketing

CLV reveals who creates your current customer base, has a high brand loyalty, and which customers ensure future cash flows. Once you identify the top 10–20% who drive the majority of profits, you can tailor campaigns to attract more people like them and retain them longer.

-

Email flows can be segmented by entire customer lifecycle tiers.

-

Lookalike audiences can be based on high lifetime value calculation cohorts.

-

Ad creative can tailor content to those with brand loyalty vs new customers.

This means every dollar spent on marketing is more strategic and data-backed.

It informs product, pricing, and CX decisions

When you understand what drives average customer loyalty, you can optimize the entire ecommerce customer journey experience around it.

-

Which products are most frequently bought by high customer lifetime value figures?

-

What price points lead to more repeat purchases?

-

Where are customers dropping off after the second purchase?

CLV isn’t just for marketers; it’s an insight engine for product development, UX design, fulfillment, and even brand positioning.

It’s a competitive advantage most brands overlook

The ecommerce space is flooded with competition. Many brands obsess over ROAS, CPMs, or CTRs, but few focus on how historic customer lifetime value gives an advantage in long-term customer retention rates.

Agencies that prioritize CLV help clients stand out. It’s no longer about who can spend the most on ads; it’s about who can build the deepest, constantly growing customer relationships. And brands that do that well tend to dominate their category.

Customer lifetime value = long-term growth, not just short-term gains

Focusing on CLV doesn’t mean ignoring new customer acquisition; it means making acquisition smarter and retention stronger. For ecommerce agencies, it’s an opportunity to deliver lasting value, not just traffic spikes or momentary boosts.

Want to impress your next client? Show them how to increase average order value, reduce churn, and turn one-time buyers into loyal customers and brand advocates. That’s what customer lifetime value analysis and strategy deliver.

Looking for a beneficial partnership?

Join our Solution Program to unlock a new revenue stream and stand out from the competition.

How ecommerce agencies can leverage customer loyalty

Understanding customer lifetime value is one thing, but putting it to work is where agencies can make an impact. Ecommerce brands often don’t have the time, bandwidth, or in-house expertise to analyze their CLV and act on it. That’s where agencies step in: not just as service providers, but as strategic partners driving long-term growth.

Here’s how smart ecommerce agencies are helping their clients get more out of every customer relationship:

Audit and analyze the data

Start with the basics. Agencies should help clients calculate their average customer lifetime value accurately and regularly. Use historical sales data to understand:

-

Average order value

-

Repeat purchase rate

-

Time between purchases

-

Best customer lifespan

-

Churn rate

Pro tip: Segment the data. Not all customers behave the same. Look at high-CLV vs low-CLV cohorts and analyze what differentiates certain customer segments (like product category, acquisition source, location, and maybe more).

Build CLV-based customer segments

Once you’ve identified high-value customer groups, build marketing strategies around them. Create tailored experiences and messaging for:

-

VIPs: Offer early access, exclusive products, or loyalty perks.

-

Mid-tier: Use win-back flows, upsells, and personalized incentives.

-

One-and-dones: Identify friction points and run post-purchase surveys.

These segments aren’t static; they evolve. Agencies should help clients monitor shifts and adjust strategies accordingly, based on historical data.

Optimize lifecycle and retention campaigns

Retention is where customer lifetime value grows. Agencies should build out automated, behavior-driven flows that speak to customers at every stage:

-

Welcome series: Set the tone and educate new customers, ensuring customer satisfaction from the get-go.

-

Post-purchase: Cross-sell, request reviews, or offer subscriptions.

-

Re-engagement: Target customers and pull them back before they churn.

-

Loyalty: Celebrate milestones and offer reward points or perks to the best customers.

Email and SMS are powerful retention channels when done right; they drive repeat purchases and increase order frequency.

Personalize the customer experience

Use customer lifespan data to personalize product recommendations, content, and even the site UX. Think:

-

Smart product bundles based on past purchases and purchase frequency.

-

Personalized “You Might Like” carousels tailored to your customer base might increase customer satisfaction and average purchase value.

-

Dynamic pricing or exclusive discounts for loyal buyers and high-value customers.

By tailoring the experience, you make the customer feel seen, and that increases customer retention naturally.

Run experiments focused on CLV uplift

Most A/B tests focus on short-term KPIs like conversion rate or ROAS. But smart agencies start testing for the long game. For example:

-

Which landing pages lead to higher repeat-purchase rates?

-

Which incentive structures (like free shipping vs 10% off) lead to higher customer lifetime value models?

-

Does offering a subscription boost long-term retention and basic customer lifetime?

Use retention metrics and CLV uplift, not just first-purchase behavior, as your North Star for testing outcomes.

Turn post-purchase into a revenue engine

The moment after a customer buys is often neglected, but it’s a goldmine. Agencies can help brands turn post-purchase communication into a strategic loop:

-

Order follow-ups with upsell offers, based on customer data.

-

Educational content for the average customer to increase product satisfaction.

-

Loyalty nudges (like “You’re only 10 points away from VIP status!”) for valuable customers.

Every message is an opportunity to build trust and encourage repeat behavior.

Reduce churn with predictive insights

Don’t wait for customers to go quiet, predict when they’re about to drop off, and intervene. Agencies can use predictive customer lifetime and purchase cadence data to set up automated churn-prevention flows. For instance:

-

“We miss you!” campaigns before the customer disappears

-

Reminders tied to replenishment cycles (great for consumables)

-

Surprise-and-delight emails to revive low-engagement segments

In summary, ecommerce agencies that understand and act on CLV become more than marketing partners — they become growth architects. By weaving customer lifetime value strategy into acquisition, retention, and customer experience, agencies can drive measurable, compounding success for their clients.

Common mistakes ecommerce agencies make with CLV

While most ecommerce agencies understand that customer lifetime value is important, many still stumble when it comes to actually implementing it as a strategic pillar. Focusing too much on quick wins or misinterpreting data can lead to misaligned priorities and leave serious growth on the table.

Here are the most common mistakes agencies make when dealing with CLV (and how to avoid them):

Chasing ROAS without looking at the full picture

Return on ad spend (ROAS) is the go-to metric for many performance-driven agencies. But if you’re optimizing solely for ROAS on first purchase, you’re only seeing part of the story.

The problem?

A customer with a low initial ROAS might go on to spend 5x more over the next 12 months, especially if retention efforts are strong. Ignoring customer lifetime value means you risk undervaluing potentially loyal, high-margin customers.

Better approach:

Track CLV by acquisition channel and use it to rebalance budgets; invest more in channels that bring long-term value, not just cheap clicks.

Treating all customers the same

Not all customers have the same potential. Some might buy once and never return, while others become repeat buyers, brand advocates, and spenders during every sale.

The mistake?

Sending the same messages, offers, and experiences to everyone, regardless of their past behavior or future value.

How to fix it:

Segment customers by customer value tiers and personalize retention strategies. For example:

-

Reward VIPs early and often

-

Educate and nurture mid-value customers

-

Re-engage low-value customers with smarter incentives

Ignoring the post-purchase experience

Many agencies do a great job getting the first sale, but drop the ball after that. Customer lifetime value doesn’t grow unless customers are nurtured after they buy.

What gets missed?

-

Post-purchase email flows

-

Loyalty/reward programs

-

Thoughtful follow-ups and re-engagement campaigns

-

Frictionless support experiences

Remember:

CLV is built over time. Without a strategy beyond “Thank you for your order,” you’re not giving customers a reason to come back.

Not measuring the right metrics

If your agency only tracks top-line revenue or order volume, you’re missing the deeper story of customer behavior. Without the right data, it’s hard to make informed decisions about predictive customer lifetime value.

Common oversight:

Not calculating CLV at all, or calculating it using outdated or oversimplified formulas.

Solution:

Use tools like Shopify analytics, Lifetimely, Triple Whale, or Google Looker Studio dashboards to track:

-

CLV by cohort

-

Churn rate

-

Repeat purchase rate

-

Time between purchases

-

CLV/CAC ratio

Treating CLV as a “one and done” metric

Customer lifetime value isn’t static; it shifts based on product changes, seasonality, customer behavior, and marketing efforts. Yet many agencies calculate customer lifetime once and never revisit it.

Result?

Decisions are made based on outdated customer value assumptions.

Smarter play:

Treat customer lifetime value calculation like a dynamic, ongoing health metric. Review it quarterly. Segment it by campaign, product, or customer type to find growth opportunities.

Overlooking support and customer satisfaction as CLV drivers

Many agencies silo customer support away from strategy, assuming it’s the brand’s responsibility. But support is often the biggest loyalty trigger in the ecommerce customer journey.

Missed opportunity:

Not optimizing the support experience: chat response time, refund handling, personalization, or proactive communication.

Easy win:

Help clients implement LiveChat or AI chatbots. Even small upgrades in responsiveness and personalization can meaningfully boost CLV.

Avoid the short-term trap

The most successful ecommerce agencies balance short-term wins with long-term vision. CLV isn’t a vanity metric; it’s the foundation of scalable, sustainable growth. When you avoid these common pitfalls and help your clients play the long game, you’re not just delivering better results, you’re building better businesses.

Looking for a beneficial partnership?

Join our Solution Program to unlock a new revenue stream and stand out from the competition.

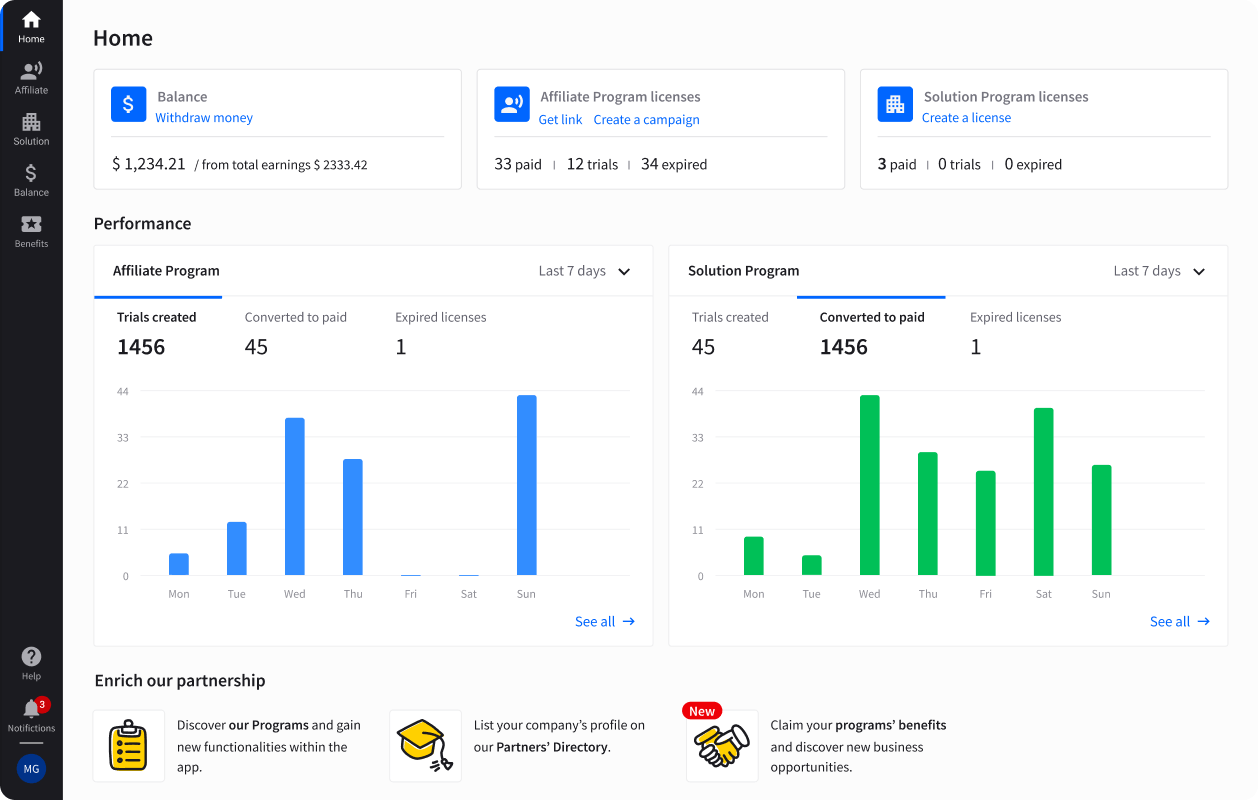

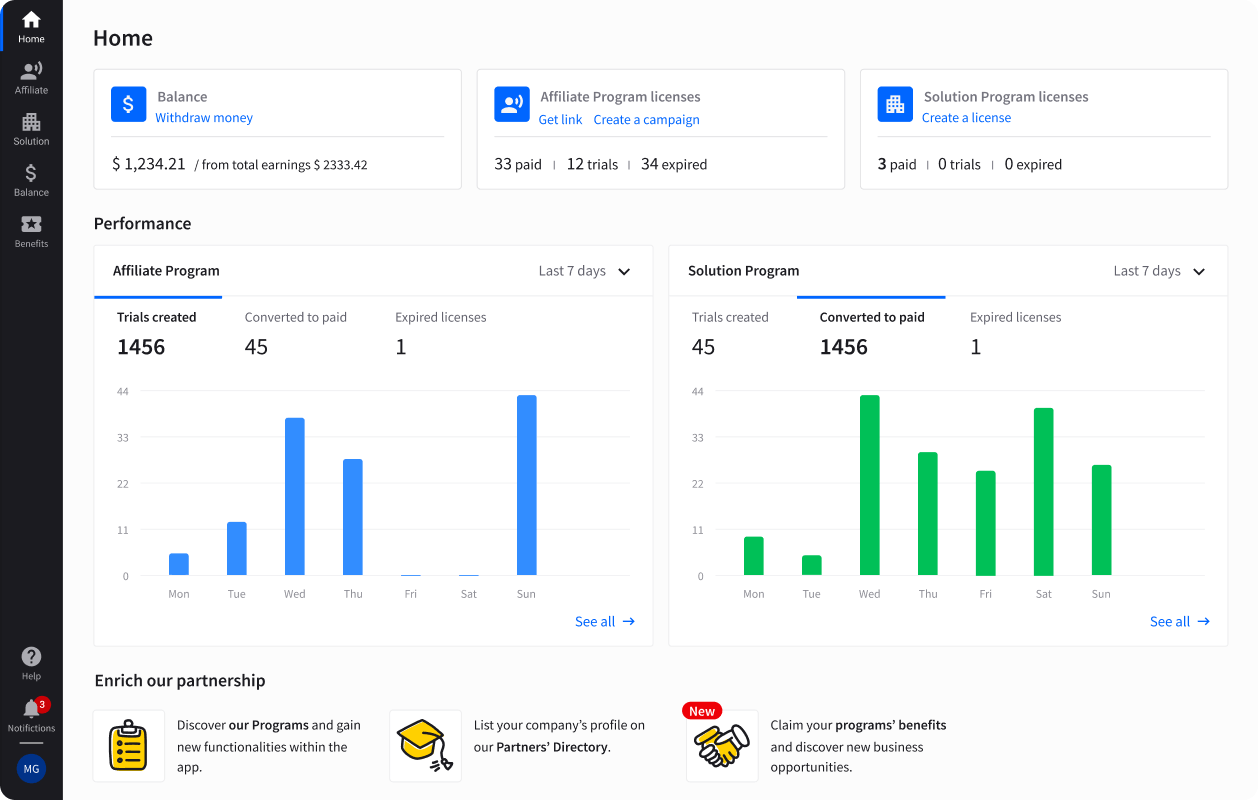

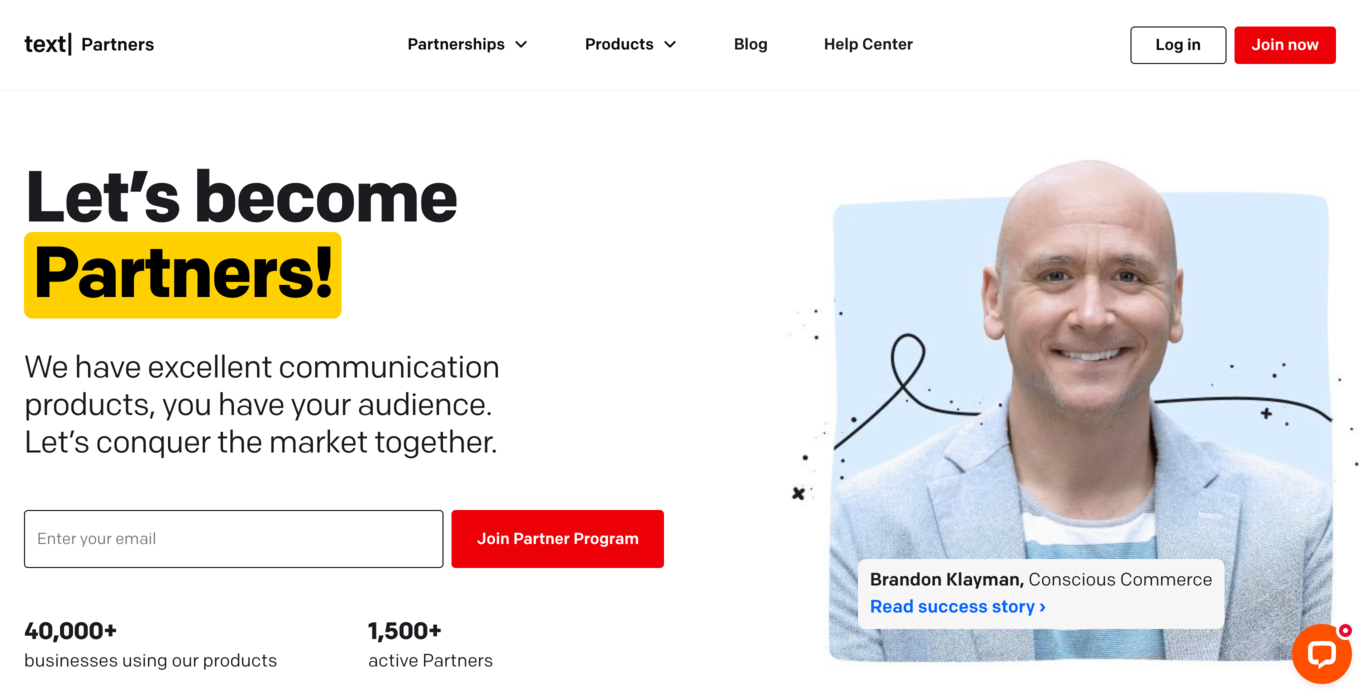

Why joining the Text Partner Program amplifies your CLV strategy

If your agency is serious about helping clients grow customer lifetime value, it’s time to think beyond ads and email flows. You need to think about customer experience, and Text’s products are the best way to level it up.

Here’s why the Text Partner Program is a smart move:

It boosts engagement at critical moments

Text lets brands have real-time conversations with customers right when they need them: on the product page, during checkout, or when they’re unsure, with LiveChat and ChatBot. These timely interactions reduce friction, build trust, and increase conversion rates and repeat purchases.

More engagement = more satisfied customers = higher CLV.

It opens up new revenue streams for your agency

As a Text Partner, you can:

-

Offer implementation, chatbot development, and optimization services

-

Provide retention-focused training for support teams

You’re not just improving your client’s bottom line; you’re expanding your own.

It gives you data to inform smarter strategies

LiveChat integrates with CRMs, ecommerce platforms, and analytics tools. That means you can track which conversations lead to purchases, which support agents drive loyalty, and which customer segments respond best to proactive engagement.

This data directly feeds into your customer lifetime value analysis and optimization workflows.

It enhances the post-purchase experience

LiveChat and ChatBot aren’t just for pre-sale questions. Agencies can help brands use it for:

-

Order updates and support

-

Personalized post-purchase follow-ups

-

Proactive customer feedback collection

These moments create positive brand experiences that turn first-time buyers into long-term fans.

Takeaway

Customer lifetime value is the ultimate growth lever in ecommerce, and agencies that master it will lead the next generation of client partnerships. Whether it’s through smarter segmentation, better retention strategies, or improved customer service, the goal is simple: get more value out of every customer relationship.

Partner programs like Text aren’t just nice add-ons: they’re powerful tools that enable agencies to deliver on this promise. They combine revenue potential for your business with deeper impact for your clients. And that’s the sweet spot.

Tools and technologies to track the average customer lifespan

Tracking customer lifetime value doesn’t have to be complicated, but it does require the right tools. Whether you’re just getting started or managing data across multiple channels, the right tech stack can make all the difference.

Below is a comparison of the most popular tools ecommerce agencies use to monitor, analyze, and improve customer lifetime value, starting with one of the most impactful: LiveChat.

| Tool | Purpose | Key features | Best for | Platform compatibility |

|---|---|---|---|---|

| LiveChat | Customer engagement | Real-time support, proactive chat, integrations with CRM and ecommerce tools | Conversion and retention via better support | Shopify, WordPress, BigCommerce, others |

| Shopify Analytics | Native CLV tracking | Order history, customer cohort analysis, AOV, repeat rate | Beginners or Shopify-native brands | Shopify |

| Lifetimely | Dedicated CLV platform | Cohort reports, LTV by product/channel, CAC vs CLV | Shopify stores focused on retention | Shopify |

| Klaviyo | CRM + Email/SMS automation | Predictive CLV, churn risk, segmentation, automation | Lifecycle marketing and re-engagement flows | Shopify, WooCommerce, BigCommerce |

| Triple Whale | Attribution + LTV analytics | Blended ROAS, cohort LTV, marketing attribution | Paid media-focused DTC brands | Shopify (primarily) |

| Daasity | Advanced BI and retention analytics | LTV by product, forecasting, multi-source data analysis | Mid-market to enterprise DTC brands | Shopify, Amazon, custom integrations |

| Google Analytics 4 (GA4) | Web behavior + LTV tracking | Lifetime value report, revenue/user, retention reports | Brands looking to unify web + ecommerce data | All platforms with integration |

| Looker Studio | Custom dashboards and visuals | Client-ready reporting, cohort tracking, data storytelling | Agencies managing multiple accounts | Integrates with GA4, BigQuery, Sheets |

| HubSpot CRM | Lifecycle + contact-level CLV | Purchase history, contact scoring, workflow automation | Personalized sales and service flows | Shopify, WooCommerce, Magento, more |

Measuring customer lifetime value success

Once you’ve put your customer lifetime value strategy into motion, the next step is to track its impact. Measuring CLV success isn’t just about watching a number go up; it’s about understanding why it’s going up, who is driving it, and what actions are working. This is where ecommerce agencies can truly prove their value. Here’s how to approach it:

Core metrics to track alongside CLV

Customer lifetime value doesn’t live in a vacuum. It’s influenced by (and tied to) a variety of supporting metrics.

If your agency is helping a brand grow CLV, keep your eye on:

-

Repeat purchase rate (RPR): the percentage of customers who come back to buy again. A rising RPR typically means your retention strategies are working.

-

Average order value (AOV): the total revenue divided by the number of orders. Upselling, bundling, or loyalty perks should gradually lift AOV over time.

-

Purchase frequency: Total orders divided by unique customers. High frequency = more engagement = higher CLV.

-

Customer churn rate: the percentage of customers who stop buying after a period. Reducing churn directly increases customer lifespan and, in turn, CLV.

-

CLV to CAC ratio (CLV: CAC): customer lifetime value divided by customer acquisition cost. Ideally, this should be 3:1 or higher. It’s one of the best signals of long-term profitability.

Time-based cohort tracking

Don’t just measure overall CLV; track it across time-based cohorts. For example:

-

Customers acquired in Q1 2024

-

Customers who first bought via an Instagram ad campaign

-

Customers who started with a subscription product

This helps you identify which acquisition channels bring in the most valuable customers, how customer value evolves month over month, and what lifecycle campaigns drive the most loyalty.

Pro tip: Tools like Lifetimely and Triple Whale make this super easy to visualize.

Segment CLV by customer type or product

Not all customer lifetime value growth comes from everyone; often, it’s your top segments pulling the weight. Break CLV down by:

-

Customer type: New vs repeat, one-time vs subscriber

-

Demographics: Location, device, purchase time, and more

-

Acquisition source: Paid search vs organic vs influencer

This segmentation allows you to double down on what works and pull back on low-performing efforts.

What’s actually driving CLV growth

It’s easy to see customer lifetime value go up, but harder to know why. That’s where attribution comes in. Try to answer:

-

Did our new welcome email sequence increase CLV?

-

Did our loyalty program launch reduce churn?

-

Are customers who used live chat before buying more likely to return?

Use split testing and multi-touch attribution tools to connect strategy to results. This is especially important for agencies looking to justify ROI in client reports.

Set benchmarks and watch for lift

What counts as “good” customer lifetime value depends on the brand, vertical, and product type. A subscription skincare brand might have a CLV of $400+, while a one-time novelty store might average $50.

Set realistic, tiered benchmarks, like:

-

Short-term (30-day CLV): Are we seeing quick value?

-

Mid-term (90–180 day CLV): Are customers sticking around?

-

Long-term (12+ month CLV): Are they becoming loyalists?

From there, you can monitor CLV lift after implementing a strategy, such as onboarding flows, loyalty programs, or retention campaigns.

Make CLV reporting a recurring practice

Don’t just check in once. Include customer lifetime metrics in:

-

Monthly client reports

-

Quarterly reviews

-

Campaign retrospectives

Position CLV as a key performance indicator (KPI), not just a “nice-to-have” number.

CLV success = sustainable growth

When you measure customer lifetime value correctly, you’re not just proving campaign ROI; you’re guiding smarter decisions across acquisition, retention, customer service, and product development. And as an agency, that makes you an indispensable growth partner.

Final Thoughts

It’s easy to chase short-term wins: more clicks, more conversions, more ROAS. But the brands (and agencies) that stand the test of time are the ones that play the long game. That means shifting your mindset from “How do we get a sale today?” to “How do we build lasting customer relationships that drive value for years?”

Customer lifetime value (CLV) is more than a metric; it’s a growth philosophy. When you understand it, track it, and optimize around it, you’re no longer guessing at what works. You’re making smart, strategic decisions that lead to compounding returns, loyal brand advocates, and a healthier business overall.

For ecommerce agencies, CLV isn’t just a nice KPI to talk about; it’s a clear differentiator. It’s how you prove your campaigns are driving sustainable revenue, not just vanity metrics. It’s how you position yourself not as a service provider, but as a long-term growth partner.