Showing top 0 results 0 results found

Showing top 0 results 0 results found

What you’ll learn from this article:

Key findings:

Is competitor research necessary?

For ecommerce agencies, competitor research isn’t just a supporting task; it’s central to driving smarter strategies. From pricing and SEO to ad creatives and product messaging, the insights gained from tools like Ahrefs, SEMrush, and Prisync help agencies spot gaps, respond faster, and make data-backed decisions that directly impact client performance.

Why is choosing the right tool crucial?

Using the right mix of competitor research tools, selected based on agency focus, scalability, and integration capabilities, leads to stronger outcomes. When agencies turn insights into clear actions (like SEO improvements or ad creative updates), they not only improve client KPIs but also strengthen long-term partnerships by becoming trusted growth advisors.

In ecommerce, staying competitive means more than just launching great products: it means knowing exactly what your rivals are doing, when, and why. For agencies, competitor research tools aren’t a luxury; they’re essential for driving smarter decisions across SEO, pricing, ads, and strategy.

In this article, we’ll break down the best tools ecommerce agencies can use to track the competition, spot new opportunities, and deliver better results for their clients. Let’s dive in.

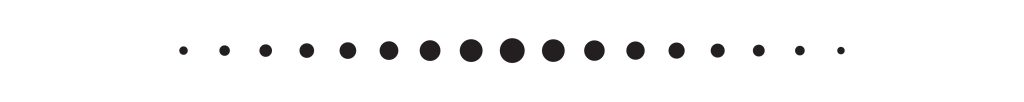

📚 Check how the Text Partner Program can accelerate your agency’s growth!

The role of competitor research in ecommerce strategy

Let’s be honest — ecommerce is crowded. Whether your client sells artisan candles or performance running gear, they’re competing with dozens (if not hundreds) of similar brands, all fighting for the same clicks, carts, and conversions. That’s why competitor analysis isn’t just a one-time audit. It’s an ongoing marketing strategy that powers smarter, faster decisions.

Know where you stand and where to go

First and foremost, competitor research gains insights. It shows how your client stacks up in the market — what their pricing looks like compared to others, how visible they are in search, which channels their competitors are leaning into, and where there are gaps worth exploring.

Spot trends before they go mainstream

By keeping a close eye on what your client’s competitors are doing — launching marketing campaigns, discounting, promoting — you can surface patterns that lead to proactive decisions. Think of it like an early-warning system for shifts in the market: changes in consumer preferences, spikes in ad spend, or even product reviews hinting at evolving customer pain points.

Uncover opportunities hiding in plain sight

Competitor data can also reveal what isn’t working, and that’s just as valuable. Maybe a competitor is investing heavily in social platforms, but engagement is low. Or they’re dominating ads, but their product pages are clunky and slow. These blind spots are entry points in your own content strategy to help your clients stand out.

Power every channel, from SEO to paid ads

The market research insights you gather feed into nearly every aspect of an ecommerce growth strategy. Keyword gaps inform SEO roadmaps. Ad intelligence shapes paid traffic strategy. Review and sentiment data guide product messaging. Pricing tools help ensure your client stays competitive without racing to the bottom.

In short: better research = better strategy = better results.

Looking for a beneficial partnership?

Join our Solution Program to unlock a new revenue stream and stand out from the competition.

14 best competitor analysis tools for ecommerce agencies

With so many competitive analysis tools out there, it can be tough to know which ones are actually worth your time and your client’s budget. To make it easier, we’ve rounded up 15 of the best tools ecommerce agencies can use.

| Tool | Category | Key use |

|---|---|---|

| Ahrefs | SEO and content | Track keywords, backlinks, content gaps |

| SEMrush | SEO and paid Ssearch | Analyze PPC and SEO strategy |

| SimilarWeb | Traffic analytics | Benchmark web traffic and referral sources |

| Prisync | Pricing intelligence | Monitor competitor pricing and MAP |

| Price2Spy | Pricing intelligence | Track SKU-level pricing trends |

| IntelligenceNode | Retail analytics | Analyze product and price data at scale |

| DataHawk | Amazon intelligence | Track keywords, ASINs, and ad spend |

| BuzzSumo | Content and social | Analyze top-performing content and shares |

| AdBeat | Ad intelligence | Uncover ad spend and placement trends |

| Brandwatch | Social listening | Track sentiment and brand mentions |

| HypeAuditor | Influencer intelligence | Audit influencer authenticity |

| SpyFu | Search marketing | Analyze Google Ads and keyword overlap |

| ReviewTrackers | Customer feedback | Aggregate and analyze reviews |

| Wappalyzer | Tech stack detection | Reveal competitor website tools |

Ahrefs

Ahrefs is a comprehensive, all-in-one solution for SEO competitor analysis and a backlink tool. It’s one of the most robust platforms for uncovering how competitors are driving organic website traffic. Agencies can track keyword rankings, backlink profiles, and top-performing content, all with historical data.

Use for clients:

-

Identify content gaps in keyword research by comparing keyword portfolios.

-

Reverse-engineer successful blog posts or category pages.

-

Monitor new referring domains to guide link-building strategy.

SEMrush

SEMrush is a single suite that covers SEO insights, paid search, content marketing, and competitive research. Agencies get a complete look at competitors’ organic and paid strategies, including keyword positions, ad copy, and traffic estimates.

Use for clients:

-

Find what competitors are bidding on in Google Ads.

-

Audit technical SEO issues.

-

Use the “Keyword Gap” tool to fuel new content strategies.

SimilarWeb

SimilarWeb provides competitor website analysis and digital behavior insights. It shows you how much traffic your client’s competitors are getting, traffic sources, and how it breaks down by channel (like organic, paid, social, or referrals).

Use for clients:

-

Benchmark traffic growth vs. top competitors.

-

Discover high-converting referral sources or affiliate partners.

-

Shape your client’s channel mix based on industry patterns.

Prisync

Prisync automates competitor price tracking and reporting for ecommerce service and market segment. In price-sensitive verticals, staying competitive without manual checks is crucial. Prisync ensures your clients can react quickly to price shifts.

Use for clients:

-

Set automated pricing rules based on competitor behavior.

-

Detect undercutting or pricing anomalies.

-

Provide your clients with actionable insights for promotions.

Price2Spy

Price2Spy is a mature price monitoring tool ideal for tracking large numbers of SKUs across competitors. It is great for brands that sell on multiple platforms and need to keep pricing consistent or within certain thresholds (like MAP).

Use for clients:

-

Monitor product pricing daily on Shopify, Amazon, and niche sites.

-

Spot patterns like price drops ahead of big promotions.

-

Use historical price data for forecasting.

IntelligenceNode

IntelligenceNode delivers AI-powered retail analytics, price comparison, and inventory insights. It’s built specifically for ecommerce and omnichannel retailers, offering SKU-level intelligence at scale.

Use for clients:

-

Get instant visibility into how competitors are pricing and displaying similar products.

-

Competitive benchmarking across global marketplaces.

-

Detect gaps in assortments.

DataHawk

DataHawk is a competitor analysis and optimization platform focused on Amazon and Walmart sellers. It merges target keyword tracking, financial performance, review monitoring, and advertising insights in one dashboard.

Use for clients:

-

Track competitor rankings for high-priority keywords.

-

See which ASINs are trending or gaining traction.

-

Monitor PPC efficiency compared to similar listings.

BuzzSumo

BuzzSumo helps identify high-performing content, track brand mentions, and discover social media influencer campaigns. Content and social performance are often overlooked in ecommerce, but they’re powerful for upper-funnel engagement.

Use for clients:

-

Analyze what blog posts or videos are going viral for competitors.

-

Find content formats (quizzes, listicles, etc.) that resonate.

-

Identify niche influencers and brand advocates.

AdBeat

AdBeat offers insights into display and native ad strategies of thousands of brands. Strong in showing where and how multiple competitors are allocating their paid media budget.

Use for clients:

-

Find out which publishers or networks competitors prefer.

-

Identify what landing pages are linked to from ads.

-

Understand split-testing strategies used by top-performing brands.

Brandwatch

Brandwatch is an advanced social media monitoring and analytics platform. Goes beyond mentions — it helps agencies understand why customers talk about a brand, what they say, and how they feel.

Use for clients:

-

Monitor competitor sentiment over time.

-

Track trending topics or seasonal brand moments.

-

Guide product messaging or PR strategy based on real consumer voice.

HypeAuditor

HyperAuditor is a social media tracker that tracks audiences and benchmarks engagement. It helps you see which influencers are working with competitors and whether those campaigns are generating authentic interest.

Use for clients:

-

Spot influencer partnerships in your niche.

-

Avoid fake followers or inflated engagement.

-

Plan campaigns with vetted creators and a competitive edge.

SpyFu

SpyFu tracks Google Ads and organic strategy of competitors, with historical ad copy and bidding data. Great for finding paid search opportunities and new competitors your client might be missing.

Use for clients:

-

See which keywords your client’s competitors are consistently buying.

-

Discover ad copy themes that convert.

-

Build smarter PPC strategies backed by real-world results.

ReviewTrackers

ReviewTrackers collects and analyzes online reviews across Google, Amazon, Yelp, Facebook, and more. Reviews are one of the clearest windows into what customers like and dislike, especially useful for product and UX decisions.

Use for clients:

-

Spot common complaints in competitor reviews.

-

Analyze sentiment shifts over time.

-

Build trust by addressing gaps competitors leave open.

Wappalyzer

Wappalyzer detects the tech stack behind any website — including ecommerce platforms, analytics tools, live chat, and marketing automation. Understanding what tech your client’s competitors are using can uncover partnerships, strategy shifts, or weaknesses.

Use for clients:

-

See if a competitor recently moved to Shopify Plus, Klaviyo, or another stack.

-

Discover trends in tool adoption across your client’s category.

-

Inform your tech stack recommendations with real data.

Looking for a beneficial partnership?

Join our Solution Program to unlock a new revenue stream and stand out from the competition.

Best practices for ecommerce agencies

Knowing which tools to use is only half the battle; the real magic happens when you apply them strategically. For ecommerce agencies juggling multiple clients, industries, and platforms, having a consistent, repeatable approach to competitor research can make all the difference. Below are some best practices to help you turn data into action — and insights into impact.

Align competitive research with client goals

Every client has a different endgame, and your research should reflect that. It’s essential to align your research efforts with each client’s specific objectives. If a client wants to boost return on ad spend, your competitive insights should focus on ad spend, creatives, and conversion tactics. If the goal is to expand into a new category, you should zero in on keyword gaps, product assortments, and tech stack shifts among leading players in that space.

Build a centralized competitive dashboard

Once you’ve gathered competitive insights, don’t let them live in scattered spreadsheets, Slack threads, or PDF decks. Consolidate everything into a single, living dashboard. Whether you build it in Google Sheets, Notion, or a dedicated reporting platform, the goal is to have all your competitive intelligence accessible, comparable, and easy to update.

A strong dashboard lets you and your clients see trends at a glance, such as pricing shifts, keyword movement, or emerging content themes, without having to wade through a maze of exports.

Make it ongoing, not one-and-done

Competitive research isn’t a quarterly box to check. It needs to be a recurring, embedded part of your agency’s workflow. In ecommerce, the competitive landscape changes quickly, especially during promotional windows, seasonal spikes, and new product drops.

Your research process should keep up. That might mean tracking prices weekly, reviewing new ad creatives every couple of weeks, or refreshing SEO competitor analysis reports every month. The cadence should match the pace of your client’s category. Not only does this keep your recommendations relevant, but it also creates regular value checkpoints for your clients.

Turn insights into actions

Gathering data is only half the job — interpreting it and making it actionable is what drives results. When you uncover a pricing drop, SEO surge, or spike in customer complaints on a competitor’s site, the next step is translating that into a decision.

Should your client adjust their price? Should they publish a new blog post targeting the same keyword? Should they tweak their ad messaging to address a gap? The more clearly you can connect insight to action, the more strategic and indispensable your agency becomes.

Automate where you can

Time is one of your agency’s most valuable resources. Many of the best tools come with automation features (like API access, alerts, and scheduled reports) that can save hours of manual effort.

You don’t need to hand-check competitor prices or refresh keyword reports every week if you can get notified the moment something changes. Automating these workflows not only increases your team’s efficiency but also ensures you’re working with fresh, timely data when it matters most.

Use research to fuel experimentation

Finally, treat competitor research as a springboard for testing, not copying. If a competitor is leaning into social media platforms or bundling products in a new way, that’s a sign to explore, not imitate.

The most forward-thinking agencies use these signals to design small, controlled experiments, measure results, and adapt fast. Sometimes, the test will confirm a new direction; sometimes, it won’t. But in either case, you’re learning faster than the competition — and that’s an edge your clients will feel.

Tool selection criteria

With so many competitive analysis tools available (each offering slightly different features, pricing models, and integrations), it’s easy to get overwhelmed. The goal isn’t to stack up every shiny platform you come across but to build a lean, focused toolkit that fits your agency’s workflow and delivers clear value to your ecommerce clients.

Functionality that matches your services

Start by mapping tools to the actual services your agency provides. If your bread and butter are paid media, then a tool like AdBeat or Moat will be far more useful than a deep SEO platform. On the other hand, if you offer Amazon optimization or marketplace management, DataHawk or IntelligenceNode would provide more relevant insights.

A good rule of thumb: choose tools that help you do what you’re already good at rather than tools that create new work without a clear ROI.

Scalability for multiple clients

As your agency grows, so does the complexity of managing multiple accounts across different verticals. Tools that are great for solo operators or small teams may fall short when you need to scale reporting across 10, 20, or more clients.

Look for features like multi-project dashboards, client tagging, white-labeled reporting, and permission management. Tools with bulk export capabilities or built-in automation will save you hours of manual tracking and make it easier to systematize your insights across client portfolios.

Real-time or frequent data updates

Speed matters. In ecommerce, prices shift, products go out of stock, and ad campaigns pivot, often overnight. Relying on outdated snapshots can lead to missed opportunities or bad calls. Prioritize tools that provide frequent or real-time data updates, especially in areas like pricing, advertising, and organic rankings.

API and reporting integrations

The best tools don’t just hold data, they share it. If you already use platforms like Looker Studio, Notion, Airtable, or even Google Sheets for reporting, make sure the tools you choose integrate easily.

APIs, Zapier support, and native reporting widgets can make it seamless to pull competitor insights directly into dashboards. This saves your team time and gives your clients real-time visibility into the metrics that matter — without the need to manually copy-paste screenshots or build custom visuals from scratch.

Ecosystem compatibility

Many tools overlap in function but vary in how well they “talk” to the rest of your stack. Consider how each tool fits into your broader ecosystem. Will it replace an existing system? Complement it? Cause duplicate work?

For example, if you already use a project management system like Asana or Trello, does the tool offer task automation or alerts? If you’re already using LiveChat or Shopify Plus, does the platform offer ecommerce-specific insights or direct integrations?

The more connected your stack, the more efficiently your team can move, and the more cohesive your recommendations will be.

Value vs cost

Finally, it’s important to weigh the price of each tool against the value it brings to your agency and your clients. Some tools might seem expensive on paper, but can replace multiple-point solutions or drastically reduce manual work. Others may look affordable but require additional tools to fill in the gaps, which adds complexity and cost.

Always evaluate tools based on total return — time saved, insights gained, and results delivered. If a tool helps you win one new client or extend a contract, it’s likely worth the investment.

Looking for a beneficial partnership?

Join our Solution Program to unlock a new revenue stream and stand out from the competition.

An ecommerce agency in action (a short case study)

To bring all of this theory into the real world, let’s walk through a real-life scenario — a simplified (but realistic) case study showing how an ecommerce agency used competitor research tools to drive meaningful results for a client.

The Client

A mid-sized DTC (direct-to-consumer) home goods brand selling premium bedding and sleep accessories. They were operating on Shopify and had decent brand awareness but were struggling to grow beyond paid social and felt “stuck” on the SEO front. Their category was becoming increasingly saturated, with several well-funded competitors ramping up visibility and customer acquisition.

The client brought in an ecommerce agency to help drive multi-channel growth, with a focus on organic traffic, smarter ad spend, and increased conversion rates.

The Agency’s Approach

Instead of guessing what might work, the agency kicked off with a deep competitive research sprint using a curated stack of tools:

-

SEMrush and Ahrefs were used to identify SEO keyword gaps between the client and three key competitors. This revealed dozens of high-intent, bottom-of-funnel keywords (like “organic bamboo sheets” and “cooling pillow for hot sleepers”) that the client had yet to target.

-

With Moat and AdBeat, the agency analyzed competitors’ ad creatives across Facebook, Google Display, and YouTube. They noticed a trend: competitors were heavily pushing UGC-style video testimonials, with a focus on temperature regulation and sleep quality. The client’s ads, meanwhile, leaned heavily on generic lifestyle photography.

-

ReviewTrackers was brought in to scrape competitor product reviews. Common customer complaints centered on long shipping times, unclear care instructions, and confusing return policies — areas where the client already had an edge, but wasn’t communicating effectively.

-

The team also used BuzzSumo to monitor top-performing competitor blog content. They found that educational articles (like “How to Choose the Right Mattress Protector”) consistently earned backlinks and ranked well. The client’s blog was mostly dormant and offered no structured content strategy.

The Execution

Armed with these insights, the agency built a three-pronged roadmap:

-

SEO expansion: A new content calendar targeting the missed long-tail keywords was launched. They created optimized landing pages and blogs that spoke directly to customer pain points found in reviews.

-

Ad creative revamp: They produced short, social-style video ads highlighting fast delivery, hassle-free returns, and product quality — echoing exactly what competitor reviews showed customers cared about. These replaced the static image ads and were tested across Meta and YouTube.

-

Site messaging update: The agency worked with the client’s design and CRO team to emphasize key differentiators (fast shipping, clear care instructions, customer support) across the homepage, PDPs, and checkout flow.

The Results

Within 90 days, the client saw an increase in non-branded organic traffic, largely driven by the new content and on-page optimizations. Paid social ROAS improved after rolling out the new ad creatives, and the bounce rate on PDPs dropped, indicating that the updated messaging was resonating.

Moreover, the agency earned a long-term retainer and positioned itself as a true strategic partner, not just a tactical service provider.

Conclusion

Competitor analysis isn’t just about watching what others do — it’s about using those insights to drive smarter, faster decisions for your clients. With the right tools and strategy, ecommerce agencies can turn raw data into clear advantages across pricing, SEO, content, and ads.

The most successful agencies don’t just report trends, they act on them. They help clients lead, not follow. So if you’re not already making competitor research a core part of your process, now’s the time to level up, because in ecommerce, staying ahead is everything.