Showing top 0 results 0 results found

Showing top 0 results 0 results found

Ever feel like you’re throwing spaghetti at the wall with your affiliate campaigns? Hoping something sticks? Let’s stop guessing and start growing.

Tracking the right affiliate marketing metrics and KPIs is like having a treasure map for your success. From clicks to conversions, retention to revenue, these numbers tell you what’s working, what’s not, and where to focus next.

Whether you’re just starting or scaling up, knowing which metrics matter most can make all the difference. Ready to turn data into dollars? Let’s dive in and break it all down!

The role of metrics in affiliate marketing

Metrics are measurable data points that show how your affiliate campaigns are performing. Some metrics are tied to strategic goals, such as driving affiliate sales or improving customer retention.

For affiliate marketers, these might include clicks, conversion rates, and earnings per click (EPC). Tracking them allows you to understand your campaign’s success and areas needing improvement. You can also spot patterns to stay ahead in competitive niches.

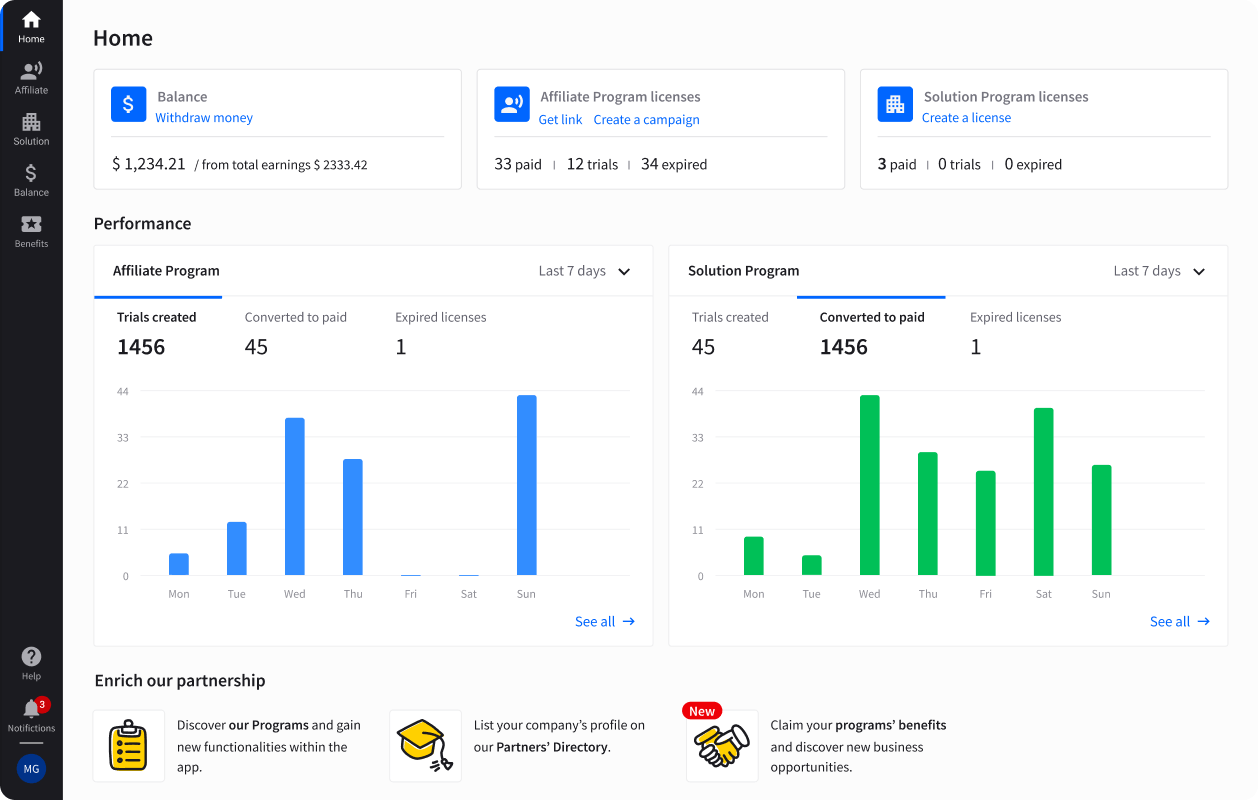

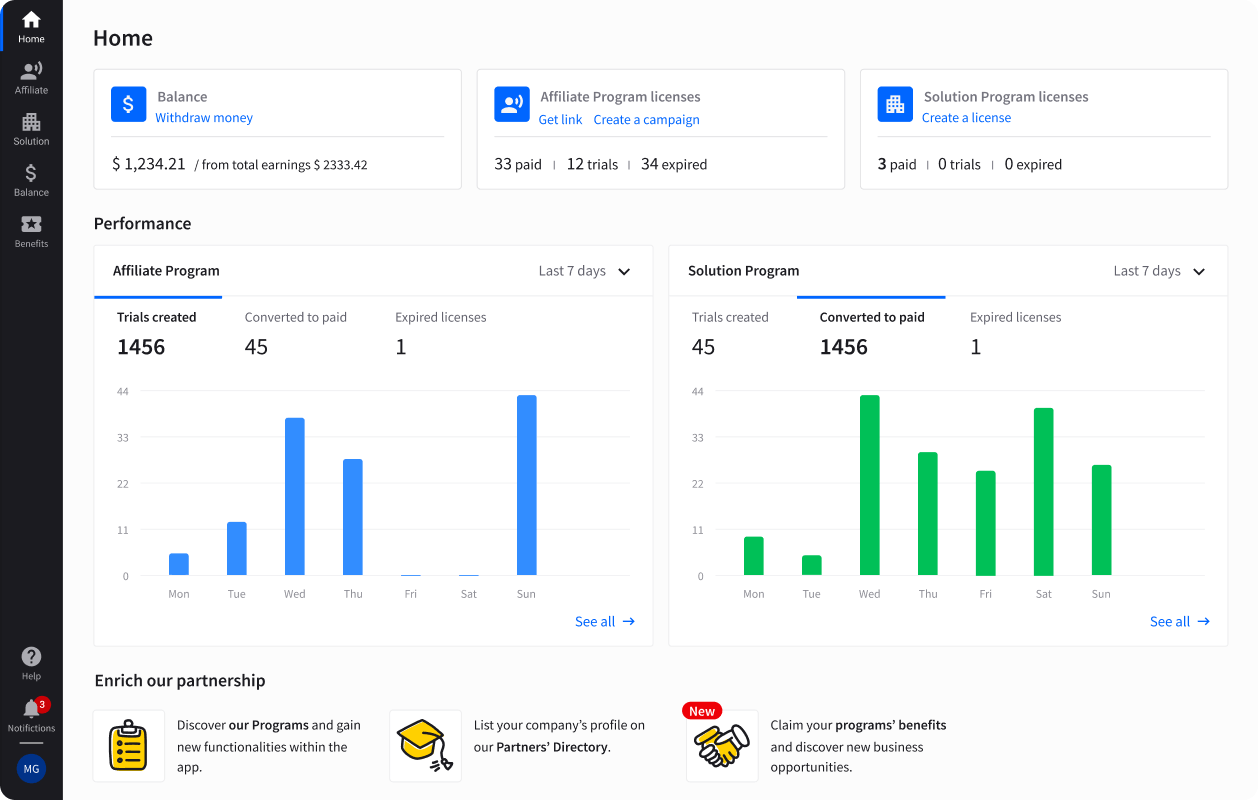

Affiliate marketers have access to various tools for tracking metrics effectively. For example, the our dashboard offers tools to track and optimize your campaign performance. Thus, you make data-driven decisions to improve results.

- Real-time performance tracking: The dashboard overviews clicks, trials, sales, and total earnings over time. You can filter data by time frames and review performance trends through detailed charts.

- Custom campaign insights: The campaign builder allows you to create campaigns with unique offers, custom landing pages, and specific tracking parameters. It also allows for more precise performance analysis and compares different marketing channels, such as Facebook or Instagram, to determine their effectiveness.

- Advanced reporting options: The dashboard supports UTM-based tracking and allows downloadable detailed CSV reports. You can get data on traffic sources, content performance, and audience behavior and refine your campaigns for better results.

Traffic and engagement metrics

Traffic and engagement metrics help you understand how visitors interact with your affiliate content. You can analyze your campaigns' effectiveness and content's appeal and make adjustments to improve performance.

1. Clicks

Clicks refer to the number of times a user clicks on your affiliate links, typically from ads, blog posts, emails, or social media.

The number of clicks shows how well your content drives user interest toward the affiliate products or services you're promoting. Tracking clicks helps you identify which content or promotional methods attract the most attention.

To track them, monitor the total number of clicks from each affiliate link in your campaign reports or dashboard.

2. Unique visitors and traffic sources

Unique visitors refer to the number of distinct individuals visiting your website or landing page, regardless of how often they visit. The metric helps you see how many new users discover your content and how often they return.

Traffic sources indicate where your visitors are coming from, such as organic search, social media, direct traffic, referral websites, or paid ads. You can then identify which channels bring in the most qualified visitors, allowing you to adjust your marketing efforts.

You can use tools like Google Analytics or your affiliate dashboard to monitor unique visitors and breakdowns by traffic source.

3. Time on page

Time on page measures how long visitors stay on a specific page or post on your website.

A longer time on the page suggests that users find the content engaging or valuable. It is important for affiliate marketing, as it indicates interest in the products or services you're promoting.

Longer engagement often correlates with better search engine rankings, as search engines see this as a signal of quality content.

To track this metric, monitor time on the page via Google Analytics or similar analytics tools. These tools provide data on how long visitors stay on each page or post.

4. Bounce rate

The bounce rate is the percentage of visitors who land on your page and leave without interacting further. For example, without clicking on any other links or navigating to other pages on your site.

A high bounce rate can suggest that visitors aren’t finding what they expected or that your landing pages aren’t engaging enough. Lowering bounce rates is key to improving conversion rates, as engaged visitors are likelier to click your affiliate links and complete purchases.

You cancheck bounce rate data with tools like Google Analytics, track it for specific affiliate marketing campaigns, and assess whether changes in your content or design impact visitor engagement.

Conversion metrics

Conversion metrics help you understand how well your traffic turns into actual leads, sales, or desired actions. They measure the effectiveness of your affiliate marketing efforts and help you optimize for better results.

5. Click-through rate (CTR)

The click-through rate measures the percentage of visitors who click on an affiliate link compared to the total number of visitors who see the link.

It shows how effectively your call-to-action (CTA) and affiliate links capture attention and prompt action. A higher CTR indicates that your affiliate links are relevant and compelling to your audience.

How to calculate CTR?

The formula for calculating the click-through rate is:

CTR = (Total Clicks / Total Impressions) x 100

Let's say you shared an affiliate link on a blog post, and the link was viewed 1,000 times. Out of those views, 50 people clicked on the link.

CTR = (50 / 1000) x 100 = 5%

So, your CTR for this affiliate link is 5%.

You can monitor CTR through affiliate dashboards or analytics tools, which show how often users click on your links compared to the impressions (views) your content gets.

6. Conversion Rate

The conversion rate tracks the percentage of visitors who complete a desired action. It can be making a purchase, signing up for a trial, or filling out a form after clicking on your affiliate link.

It shows how well your affiliate links drive actual sales or leads. A low conversion rate suggests that while driving traffic, your content or landing page might need improvement to convert visitors into customers.

How to calculate the conversion rate?

The formula for conversion calculation is:

Conversion rate = (Total conversions / Total clicks) x 100

Now, let’s say that out of the 50 people who clicked on your affiliate link, 10 made a purchase.

Conversion rate = (10 / 50) x 100 = 20%

So, your conversion rate for this campaign is 20%.

You can track conversions and clicks via your affiliate dashboard or through advanced analytics platforms, which allow you to set up conversion tracking and goals.

Become our Affiliate Partner!

Join forces with us and earn up to 22% commission for promoting our products.

Revenue metrics

Revenue metrics are essential to measure the financial success of your affiliate marketing campaigns. They help you understand how much money you're making from each click, how much it costs to acquire a customer, and the overall profitability of your efforts.

7. Earnings per click (EPC)

Earnings per click (EPC) calculates the average amount of money you earn for every click on your affiliate links. It helps assess the effectiveness of your affiliate links in generating revenue. A higher EPC means you earn more for each click, indicating better-performing affiliate campaigns.

It is also useful for comparing the performance of different campaigns or affiliate offers. Based on EPC, you can identify which campaigns are more profitable.

How do you track EPC?

Formula: EPC = Total earnings / Total clicks

For example, if you earned $200 from an affiliate campaign, and the campaign generated 1,000 clicks on your affiliate link, then earnings per click would be $0.20.

EPC = $200 / 1,000 clicks = $0.20

You can monitor EPC via your affiliate dashboard, which details clicks and earnings for each link. This metric can also be calculated to identify top performers for individual campaigns or products.

8. Cost per acquisition (CPA)

Cost per acquisition refers to the cost of acquiring a new customer or conversion through your affiliate marketing efforts. It includes all expenses related to the campaign, such as ad spend, content creation, or other marketing activities.

It helps you understand how much you're spending to acquire each customer. A lower CPA means acquiring customers more efficiently, contributing to higher profitability.

You can optimize your budget by comparing CPA with your average order value (AOV) or customer lifetime value (CLV) if necessary.

How do you calculate cost per acquisition?

The formula for calculating it is:

CPA = Total cost of campaign / Total conversions

You can track your CPA using the total costs of running your campaigns and the number of conversions (sales or leads) generated.

Imagine you spent $500 on a paid ad campaign, resulting in 50 conversions (sales).

CPA = $500 / 50 conversions = $10

Your cost per acquisition is $10, which means it costs you $10 to acquire one customer.

Most affiliate platforms also allow you to monitor CPA alongside other affiliate marketing (KPIs).

9. Gross revenue and net revenue

Gross revenue is the total amount earned from affiliate commissions before any deductions for costs or fees.

Net revenue is the total revenue after deducting associated costs, including fees, returns, or commissions paid to other affiliates (if applicable).

Gross revenue clearly shows the amount of money coming in, but net revenue shows the actual profit after all expenses are accounted for.

Understanding both gross and net revenue is critical for assessing the true profitability of your affiliate marketing success. It can also help you identify areas where costs can be reduced, or efficiency can be improved.

How to track them?

Let’s say you earned $2,000 in gross revenue from affiliate partners. However, you had $500 in costs (e.g., ad spend, affiliate fees).

- Gross Revenue: $2,000

- Costs: $500

So, net revenue will be calculated as:

Net revenue = Gross revenue - Costs

Net revenue = $2,000 - $500 = $1,500

Your revenue after expenses is $1,500. You can monitor gross and net revenue through your affiliate dashboard or sales platform. Gross revenue is typically displayed upfront, while net revenue requires subtracting applicable fees or costs.

Quick ROI check (for affiliate campaigns)

As you track EPC, CPA, and revenue, quantify profitability with our caffiliate marketing ROI calculator.

- Input commissions/revenue and campaign costs (content, ads, tools)

- See ROI instantly and compare scenarios (e.g., organic vs. paid)

- Validate goals alongside CPA, gross/net revenue, and ARPU

10. Average revenue per user (ARPU)

ARPU measures the average revenue generated from each user or customer over a specific period. It’s one of the key performance indicators used to evaluate profitability in affiliate marketing and subscription-based businesses.

It clarifies how much revenue each user contributes on average, helping you gauge the profitability of your campaigns or offerings. You can also compare revenue performance across different time periods, campaigns, or customer segments. ARPU insights guide pricing strategies, product enhancements, and campaign optimizations to maximize revenue.

How do you calculate average revenue?

The formula is:

ARPU = Total revenue / Total active users

- Total revenue: The total income generated during a specific period.

- Total active users: The number of unique users engaged with your service during the same period.

For example, your affiliate campaigns generated $10,000 in revenue last month, and you had 500 active users. On average, each user contributed $20 to your revenue.

ARPU = $10,000 / 500 users = $20

If you notice a low ARPU, it may indicate the need to target higher-value customers or promote products with better commission rates. A higher ARPU suggests your campaign is successfully converting valuable customers.

Retention metrics

Retention metrics help you understand how well an affiliate marketing program sustains long-term customer relationships. While acquisition is important, retaining existing customers is often more cost-effective and profitable.

Here are some metrics to evaluate the success of your campaigns and keep customers engaged, continuing to purchase, and remaining loyal over time.

11. Customer lifetime value (CLV)

Lifetime value is the total revenue a business expects to earn from a customer throughout its entire relationship with the brand. It helps affiliate marketers to assess how valuable each customer is over time, not just for their initial purchase.

Also, CLV allows you to identify high-value customers. You can then prioritize these customers by customizing offers and content to retain them. A higher CLV means that the affiliate’s revenue potential is more sustainable. You can focus on nurturing long-term relationships rather than continuously acquiring new leads.

How do you measure CLV?

To calculate CLV, you need:

- Average revenue per user (ARPU): The average amount a customer spends over a specific period (e.g., monthly or yearly).

- Customer lifespan (CL): How long, on average, a customer continues to make purchases.

Here's the formula:

CLV = ARPU x customer lifespan

For example, if the average revenue per user (ARPU) is $100 per month and the average customer lifespan is 12 months, the CLV would be:

CLV = $100 x 12 = $1,200

By tracking it, you can identify the most valuable customer segments and update the marketing efforts accordingly, ensuring you invest in retaining high-value active affiliates.

12. Retention rate (revenue and customers)

Retention rate is a combined metric that evaluates customer loyalty and the value those customers contribute over time. It tracks how many of your customers remain engaged with your affiliate offerings and the revenue these loyal customers generate.

This metric offers a comprehensive understanding of long-term success by focusing on the number of retained customers and the revenue they bring. High retention rates in both areas indicate a steady flow of income from existing customers.

How to measure retention rates?

Retention rate (customer) = Non-new users this period / Total users last period

The formula measures the percentage of customers from the last period who returned in the current period. It helps assess customer loyalty and how many past customers are sticking with your affiliate program.

Retention rate (revenue) = Non-new user revenue this period / Total revenue last period

The metric compares the revenue generated from existing (non-new) users in the current period to the total revenue from the previous period. It helps determine whether the revenue from returning customers is growing or declining.

For example:

- Retention rate (customer): If you had 500 total users last period and 400 non-new users this period, the retention rate would be:

400 / 500 = 0.8 or 80% customer retention. - Retention rate (revenue): If the total revenue last period was $10,000 and $8,000 came from non-new users this period, the retention rate would be:

$8,000 / $10,000 = 0.8 or 80% revenue retention.

This means 80% of both your customers and revenue have been retained from the previous period.

13. Churn Rate

The churn rate measures the percentage of customers or revenue lost during a specific period. It is essentially the opposite of the retention rate and indicates how many users or how much revenue you’ve lost.

A high churn rate signals that customers or revenue is being significantly lost. It could point to underlying problems such as poor customer satisfaction or ineffective marketing.

Also, keeping churn low ensures that your affiliate campaigns consistently generate a return on investment, making it easier to scale and grow your business.

How to measure churn rate?

The formula for churn rate is:

Churn Rate = 1 - Retention Rate

For example, if your retention rate for customers is 80% (0.8), the churn rate would be:

1 - 0.8 = 0.2 or 20% churn.

This means you’ve lost 20% of your customers or revenue in the period. Monitoring churn helps you pinpoint where to focus your efforts to retain more users and maintain a stable income.

14. Recurring commissions

Recurring commissions are earnings you receive repeatedly for a referred customer's ongoing use or subscription of a product or service.

Unlike one-time payouts, recurring commissions ensure you keep earning as long as the customer stays subscribed. Over time, they can significantly boost your total earnings without requiring constant new conversions.

For example,

Imagine you’re promoting a SaaS product with a monthly subscription of $50, and you earn a 20% recurring commission.

Recurring commission = Subscription price × Commission rate × Number of billing cycles

If one customer subscribes for 12 months, your total earnings would be:

$50 x 20% x 12 months = $120 per customer

If you bring in 10 customers, you’ll earn $1,200 in recurring commissions over the year—all from one effort upfront!

For example, our Affiliate Program also offers recurring commissions for each referred customer who subscribes. If you promote LiveChat, ChatBot, or HelpDesk and refer customers to subscription plans, you’ll earn a percentage of their monthly or annual payment as long as they stay subscribed.

Gain a new stream of revenue

Promote our 5-star communication products and gain a steady stream of income

How to prioritize metrics based on your goals?

Knowing which metrics to focus on depends on where you are in your affiliate marketing journey. Beginners and seasoned marketers have different priorities, so let’s break it down.

- For beginners: Start with the basics. Focus on clicks, conversion rate, and earnings per click (EPC). View your audience's engagement and how well your links are performing. Don’t overwhelm yourself by diving into complex metrics too soon. Just aim to get your campaigns running and generating revenue.

- For advanced marketers: Once you’re scaling, monitor metrics like customer lifetime value, retention rates, and churn rate. These help you assess the quality of your affiliate traffic and how much value you’re getting over time.

- Scaling campaigns: If your goal is to grow, prioritize metrics that impact your bottom line, like EPC and gross revenue. Experiment with your campaigns, track performance, and double down on what works.

Balancing short-term wins with long-term growth is key. Monitor retention metrics while optimizing for immediate results. A mix of both ensures success now and in the future!

Summing Up

Tracking the right metrics isn’t just about crunching numbers. You need to understand what drives your success. Metrics like conversion rate, lifetime value, and retention rate reveal the health of your affiliate campaigns and guide smarter decisions. Without tracking and optimization, you’re flying blind.

Consistent metrics tracking helps you spot trends, refine strategies, and ensure long-term growth. It’s how you identify which campaigns are thriving and which need tweaking. By focusing on data, you can replicate success and avoid costly mistakes.

Take the Text Affiliate Program, for example. With detailed performance insights built into the dashboard, affiliates can easily monitor clicks, trials, and sales to optimize real-time campaigns. The level of tracking empowers marketers to improve performance and increase earnings with confidence.

Ready to take your affiliate marketing to the next level? Applying these metrics to optimize your campaigns and unlock your full earning potential. Whether you’re new or experienced, the key to growth is in the data. So start tracking, learning, and scaling today!