ROI Calculator: Formulas and Examples to Measure Your Returns

Let’s talk money! More specifically, how you’re turning your investments into returns.

It’s a simple yet powerful way to determine if the money, time, or effort you're putting in is paying off.

ROI calculator

Your ROI

Table of contents

Think of it as your compass...

... guiding you through the maze of investment decisions, showing you where to tweak your strategy and where to double down.

But here’s the kicker: ROI isn’t just a one-size-fits-all formula. There are different ways to calculate it, depending on your investment style.

You can track straight-up revenue, calculate complex stock gains, or even get down to the nitty-gritty of annualized ROI for long-term growth.

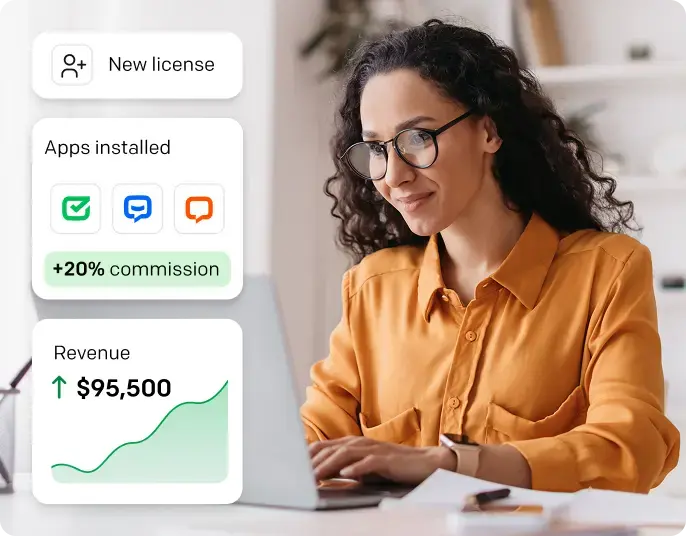

And if you're an affiliate marketer, programs like our Affiliate Program are a goldmine for solid returns.

Ready to maximize those profits?

Let’s explore it in detail!What is the return on investment?

ROI, or return on investment, is a way to determine if something you're spending money on is worth it. It’s all about understanding what you’re getting back compared to what you’ve put in.

From a digital marketing perspective:

ROI tells you how well your marketing efforts perform. Imagine you’re running a Facebook ad campaign. You spend money to get people to visit your website, and the goal is for them to buy something or sign up for a service.

ROI helps you determine whether the revenue or leads you’re getting are worth the money you spent on those ads. It’s a way to measure success and determine whether your strategy is on point or needs tweaking.

From an economic perspective:

ROI is more about the broader idea of investment efficiency. It could be applied to anything—starting a business, buying a rental property, or investing in stocks. The question is always the same: Are the returns (like profits or increased value) enough to justify the invested costs?

ROI serves as a practical gauge of how well resources are being used to generate value. It allows decision makers to assess trade-offs, prioritize ventures with higher returns, and allocate resources where they are likely to yield the greatest economic value.

Types of ROI formulas

The table below outlines three common formulas used to calculate ROI, highlighting their purpose, usefulness, what they include or exclude, and what they are best suited for.

| Standard ROI | Final and initial ROI | Annualized ROI | |

|---|---|---|---|

| purpose | Evaluates overall profitability | Measures capital gain/loss | Normalizes ROI over time to compare long-term investments |

| usefulness | Good for investment efficiency checks | Helpful for asset value growth | Good for comparing different investment durations |

| includes | Net profit, cost of investment | Initial and final value of asset | Time period, compounding effect |

| excludes | Time factor, detailed cash flow | Income during holding, time factor | Ongoing costs, irregular cash flows |

| key metric for | Basic profitability check | Capital appreciation | Long-term performance |

| Calculator | Calculate | Calculate | Calculate |

Standard ROI

ROI calculator

Your ROI

ROI - Return on investment

R - Revenue

CI - Cost of investment

This formula helps you understand the percentage return you’re getting compared to your initial investment.

Example:

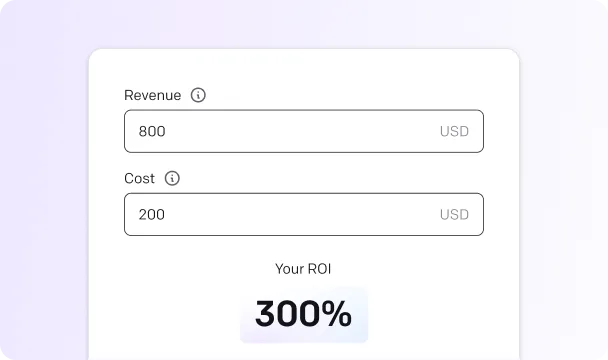

Imagine you're promoting a product through an affiliate link. You spend $200 creating content (blogs, videos, etc.) and running Facebook ads to drive traffic. After a month, you’ve earned $800 in affiliate commissions from sales made through your referral links.

To calculate ROI, you plug these numbers into the formula:

- Revenue = $800 (what you earned in commissions)

- Cost of investment = $200 (the money spent on content creation and ads)

Now, apply the numbers:

- ROI = [($800 – $200) / $200] x 100

- ROI = ($600 / $200) x 100

- ROI = 3 x 100

- ROI = 300%

So, for every dollar you spent, you earned three dollars back. This means your affiliate marketing campaign yields a 300% return, a solid indicator that your strategy is working well. It’s a great way to see how much your efforts in promoting the product are paying off!

Turn clicks into revenue

Join your online presence with our trusted communication products.

In this partnership, I was simply looking for new streams of revenue. A great thing is that I also found lots of co-marketing opportunities and amazing support.

Syed Balkhi, WPBeginner

Explore our set of text-based tools

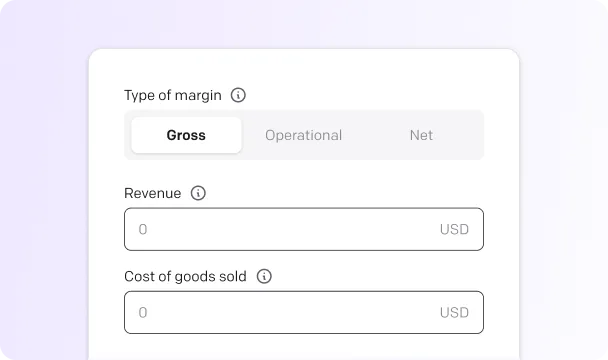

Profit Margin Calculator

Instantly check how much you’re really making on each sale.

JSON | CSV Converter

Enjoy best-in-class support to help you succeed — our team is here to assist you and your clients, anytime.

Regex Builder

A regex testing tool lets users debug regular expressions with real-time feedback.

Language Detector

Use free language identifier to detect the language of a text document or file.

Text to Speech Generator

Convert text to speech online to enjoy natural-sounding voices and high-quality audio files.

Steps to measure return on investment

Measuring ROI in digital or affiliate marketing is essential for understanding how well your campaigns perform and whether they justify the investment. Here’s how to calculate it step by step:

- Define your objectives

Start by identifying the specific goals of your campaign. Is it to drive sales, generate leads, increase website traffic, or improve brand awareness? Each objective will have its measurable metrics.

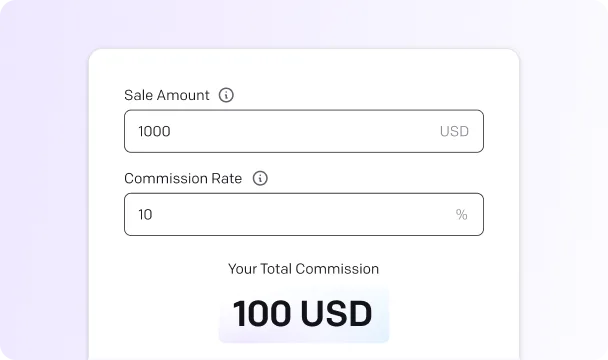

For example, sales-focused campaigns measure revenue, while lead-generation campaigns evaluate the cost per lead. Affiliate marketing, on the other hand, measures the commissions earned from promoting a third-party product or service.

- Track revenue from digital campaigns

Revenue attribution is crucial for accurate ROI. Use tools like Google Analytics, CRM software, or UTM codes to track conversions directly related to your campaigns.

For example, if you’re running a PPC ad, the revenue generated from clicks and subsequent purchases can be measured directly. In affiliate marketing, ensure you track sales generated through your affiliate links using platforms like ShareASale, Commission Junction, or SaaS affiliate programs like LiveChat.

- Calculate total costs

Include all expenses related to your campaigns:

- Ad spend (e.g., Google Ads or Facebook Ads)

- Tools and software (e.g., email marketing platforms, analytics tools)

- Content creation (e.g., videos, graphics, or blogs)

- Agency fees or in-house team costs

In affiliate marketing, the cost typically includes the resources spent on content creation, traffic acquisition, or affiliate-specific tools. Affiliate marketers may also include the cost of premium memberships or commissions paid to influencers or affiliates promoting the product.

- Plug numbers into the formula

Let’s say your digital marketing campaign generated $50,000 in revenue and cost $10,000. Using the formula: ROI = [($50,000 – $10,000) / $10,000] × 100% = 400%

This means your campaign returned $4 for every $1 spent.

For affiliate marketing, the revenue could come from affiliate commissions. For instance, if you earned $5,000 in affiliate commissions from promoting a product and spent $1,000 on content creation and paid ads to drive traffic to your affiliate links, your ROI would be: ROI = [($5,000 – $1,000) / $1,000] × 100% = 400%

- Monitor specific KPIs

Each digital marketing channel and affiliate marketing effort has unique KPIs that help assess ROI:

- PPC campaigns: Cost per conversion, click-through rate (CTR), and conversion rate.

- SEO: Organic traffic growth and revenue from search queries.

- Email marketing: Revenue per email and cost per acquisition.

- Social media: Cost per click (CPC) and sales directly linked to social campaigns.

- Affiliate marketing: Commission per sale, CPC, and conversion rate from affiliate links.

- Refine your campaigns

Regularly analyze your campaigns to identify what's working. For instance, A/B testing ad creatives or landing pages can help improve conversion rates and, in turn, ROI. Testing different affiliate programs or focusing on specific niches can optimize commissions in affiliate marketing.

Regularly evaluating and optimizing campaigns can maximize returns and drive long-term business growth, whether promoting your products or earning commissions as an affiliate marketer.

Final and initial ROI calculator

Your ROI

ROI - Return on investment

FVI - Final value of investment

IVI - Initial value of investment

This method is beneficial when your returns aren’t limited to capital gains. For example, if you’ve earned dividends on stocks or rental income from property, this formula ensures those returns are factored in.

It’s also great for cases where your initial cost includes extra expenses, like transaction fees, that need to be accounted for to give an accurate picture of profitability.

Example:

Imagine you bought 1,000 shares at $10 each, sold them a year later for $12.50 per share, and earned $500 in dividends. You also spent $125 on trading fees.

Here’s the breakdown:

- Initial value of investment: $10 × 1,000 = $10,000

- Final value of investment: ($12.50 × 1,000) + $500 (dividends) - $125 (fees) = $12,875

- ROI = (($12,875 - $10,000) / $10,000) × 100 = 28.75%

This tells you your stock market investment yielded a solid return. Also, remember that investing involves risk, and high ROI doesn’t always mean low risk, especially when leverage is involved. Whether it is savings accounts or mutual funds, you can use an investment calculator for detailed analysis.

Let's become Partners!

We have excellent communication products, you have your audience. Let’s conquer the market together.

Become our PartnerAnnualized ROI

Annualized ROI tells you the rate of return per year, assuming the investment's growth was consistent each year (compounding annually). It averages the total ROI across each investment year.

If an investment is held for several years, this formula gives you a better sense of the consistent yearly return than the total ROI.

Annualized ROI calculator

Your ROI

ROI - Return on investment

n - Number of years the investment was held

Example:

Let’s say an investment made a 60% return over 3 years, and you want to calculate the annualized ROI:

- Convert the return to a decimal: 60% = 0.60

- Plug the values into the formula. The annualized ROI is 16.96%. This means, on average, the investment grew by 16.96% each year over the 3 years.

It is useful because of:

- Consistency: It helps compare investments of different time frames on a level playing field.

- Preformance tracking: Investors can use it to assess the performance of different investments with varying holding periods.

- Decision-making: It makes it easier to compare the yearly returns of investments in stocks, bonds, or other assets, helping you determine where to allocate resources for the best returns.

Essentially, annualized ROI smooths out fluctuations in annual returns and provides a more accurate representation of long-term performance.

Join one of the highest-paying programs

our top partner earned over

$4,100,000Make big bucks with us and change your business for the better.

Become our PartnerSumming up

To wrap up, ROI is your go-to tool to determine if your hard-earned money works for you, whether you're running ads, promoting products as an affiliate, or diving into stocks.

It’s all about understanding the return your marketing efforts generate compared to what you invest. These metrics reveal how effectively your campaigns drive value — whether you’re calculating standard ROI to justify spend, measuring customer acquisition cost against revenue, or using annualized ROI to evaluate long-term brand growth.

Slawomir Pawlak, Product Marketing Manager, Text

If you're into marketing, programs like our Affiliate Program can help you earn solid returns with a service that converts. Keep refining your strategies, and you'll turn those investments into growth. No matter the game you're playing!

about the author

Slawomir Pawlak

I stumbled into the world of marketing by chance, but ended up loving it and have been working in the industry for 10 years. I have experience in various marketing roles, from agencies to software companies to startups. My expertise lies in B2B technical marketing, but I believe that all marketing is mainly human-to-human.

Read full biotext partners

Become our partner and maximize your ROI

We have excellent communication products, you have your audience. Let’s conquer the market together.

20+

years on the market

800+

leads referred to partners last year

41,000+

customers using Text products

What's in it for you?

Marketplace exposure to 37,000+ clients.

Grow your business with exposure to a global customer base looking for top-tier solutions and services.

Earn 20% recurring revenue — every month.

Start earning a predictable monthly income with every client you bring on board.

Co-marketing opportunities.

Gain access to a wealth of resources, including marketing materials, training, and support, to help you succeed.

Personal onboarding and free account.

You’ll get personal onboarding and a free product account to showcase our software.

24/7 support from our expert team.

Enjoy best-in-class support to help you succeed — our team is here to assist you and your clients, anytime.

Exclusive product discounts for your clients.

Offer your clients the best deals and help them save on essential tools.

With ChatBot and LiveChat, we're qualifying so many more leads than we were ever doing with previous campaigns.

Brandon Klayman, Conscious Commerce

$50,000 in deals and a 379% increase in website sales

Read success story